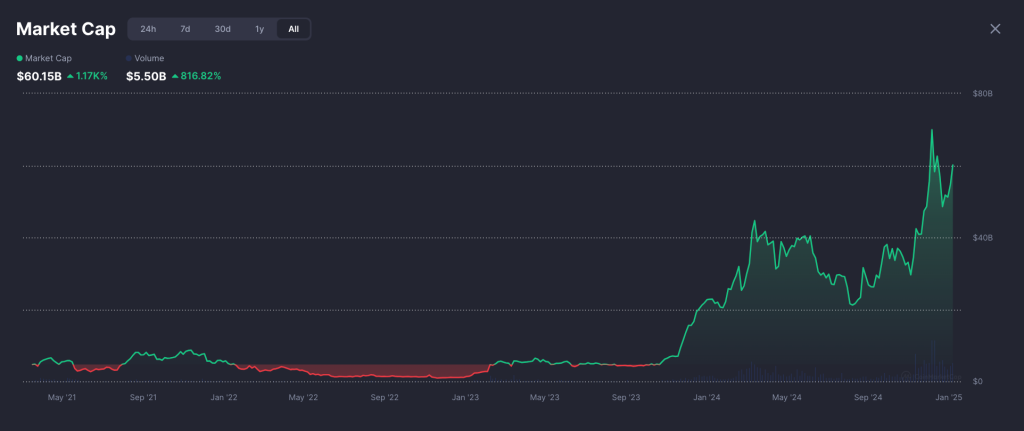

In the past two years, Crypto AI has skyrocketed 40x, growing from $1.5B to $60B since the 2023 bull run began. With VIRTUAL’s 80x rise from $50M to $4B leading the pack, AI agents and decentralized niches like Data Curation Networks (DCNs) and teeML are rewriting the rules of blockchain investing.

But is this rapid growth a GameFi-like hype cycle or the beginning of a paradigm shift in how we build and interact with the digital world? Let’s dive into the drama, risks, and opportunities.

1️⃣ The Collision of Mega-Trends: Crypto Meets AI

The crypto AI sector is exploding:

-

GAME (+353.2%) aims to be the Shopify for AI agents.

-

AIXBT (+207.3%) leverages AI for crypto market intelligence.

-

VaderAI (+213.6%) powers investment DAOs with semi-autonomous agents.

The hype is fueled by consumer agents like VIRTUAL, outpacing BTC gains by 100x in just months.

Source: CoinMarketCap

2️⃣ AI Boom: How Much Fuel Is Left?

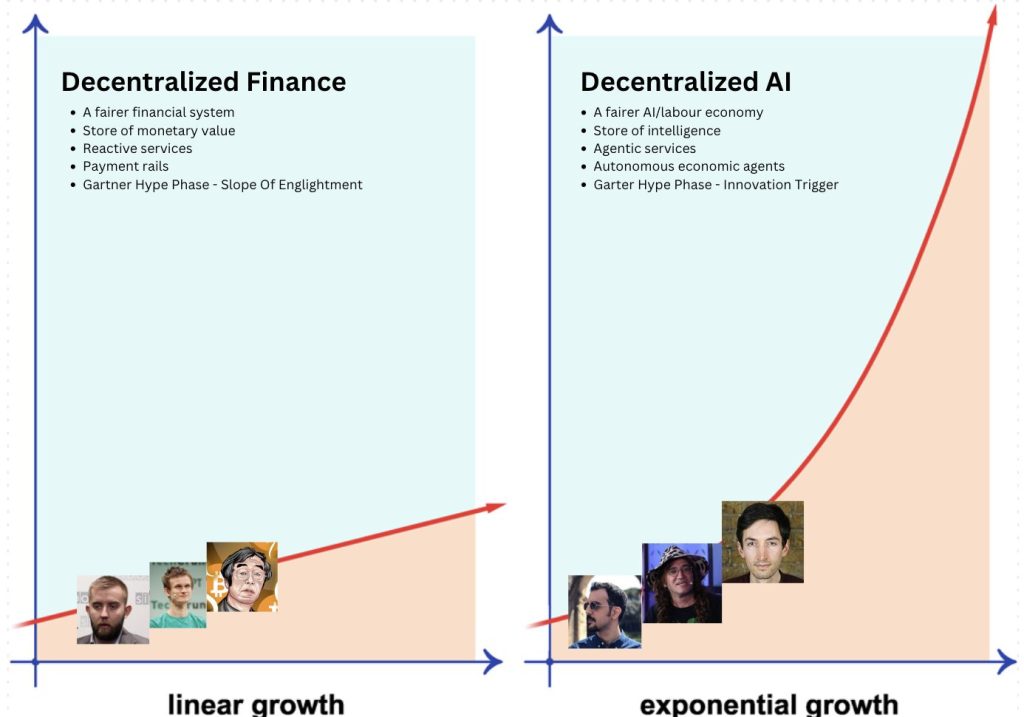

The AI sector’s meteoric rise mirrors DeFi’s 2020 boom, but valuations are turning frothy. The question looms: how sustainable is this growth?

Messari’s AI index suggests a DeFi-to-AI capital shift, with AI delivering 130% returns vs. DeFi’s 70% in 2024. Yet, DeFi’s capital base remains stronger, raising questions about AI’s long-term dominance.

3️⃣ Why AI Mirrors GameFi More Than DeFi

AI’s speculative nature and narrative elasticity make it closer to GameFi hype than DeFi utility:

-

Speculation: Valuations depend on hype over utility.

-

User engagement: Active participation drives adoption, unlike passive DeFi yields.

-

Narratives: Big ideas (Metaverse, AGI) fuel growth.

Pratik Kala sums it up: “The AI agent wave is pure hype—just like GameFi in the last cycle.”

4️⃣ AI Agents: Driving the Next Wave

With OpenAI’s Swarm framework and Coinbase’s focus on “Crypto + AI,” agents are becoming the face of this surge. These agents are speculative proxies for the larger AI trend, creating opportunities for consumer-focused innovation.

Source: Crypto, Distilled

5️⃣ Risks: The Bubble Could Burst

The sector’s explosive growth comes with dangers:

-

Overvaluation: Consumer agents may not live up to inflated expectations.

-

High churn: Bull and bear cycles are accelerating.

-

Crowded space: Many projects trade at premiums without clear differentiation from chatbots.

The $1B–$10B phase offered asymmetric upside, but near $100B, the risks outweigh the rewards for many.

6️⃣ Final Thoughts: Navigating the Chaos

Crypto AI is a double-edged sword. It’s risky, hype-driven, and speculative, but it’s also shaping the future of blockchain. Whether it’s the VIRTUAL ecosystem or new niches like teeML, the next wave of innovation is already here.

Are we heading for another bubble—or the dawn of a multi-cycle transformation?

Start building your agentic future today! One spot is left for 2025. Contact us now at hi@brnz.ai!