If your growth model still rents traffic from platforms that hoard your data and hijack checkout, your ROI math is broken before you open Excel. Margins compress, CAC drifts up, and attribution turns into a blame game. The uncomfortable truth: you can’t finance your way out of a leaky system.

Why “rented funnel” ROI collapses

When marketplaces and ad platforms control your touchpoints, three math killers creep in:

-

Data leak: you can’t capture zero/first-party signals at first contact, so retargeting and personalization underperform.

-

Friction tax: redirects and clunky checkout slash conversion (and inflate CAC).

-

One-and-done buyers: gimmicky loyalty tactics spike trials, not lifetime value (LTV).

Result: CAC rises while LTV stagnates—your payback period lengthens, and contribution margin erodes.

The own-it model (six levers, one ledger)

The fastest fix is architectural, not cosmetic. A unified growth stack turns the funnel into a flywheel:

-

Acquisition Engine – capture zero-party leads at click-in with quests/surveys (internal data shows CAC can drop up to 40%).

-

Visual Bot Builder – 24/7 conversational commerce lifts conversion and recovers revenue (typical +7–25% revenue uplift).

-

Engagement & Gamification – points, tiers, leaderboards drive repeat purchase and LTV.

-

Referral Engine – turn customers into paid advocates (proved 200% ROAS in the Buddy Bandana program).

-

Payments & Fulfilment – two-tap native payments (PayPal, Stripe, crypto) lift checkout from ~2% to >6%.

-

Intelligence Dashboards – live CAC, AOV, cart recovery, LTV; every decision is data-backed, not opinion-led.

Own the stack, and every lever talks to the others. Acquisition feeds bots; bots feed purchases; purchases trigger referrals; referrals return as low-CAC buyers; dashboards optimize the loop.

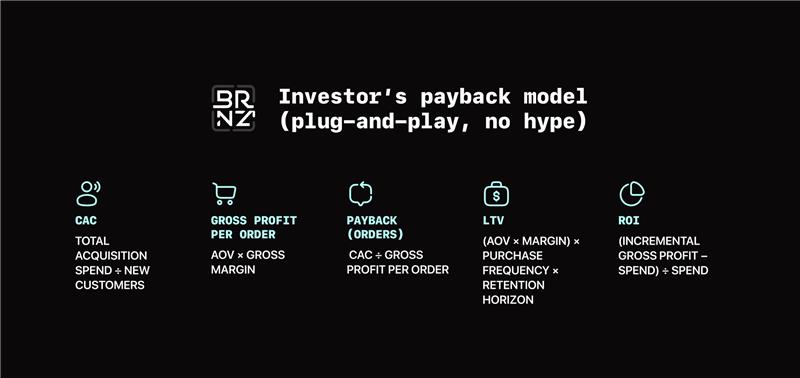

Investor’s payback model (plug-and-play, no hype)

Here’s how owning the journey shortens time-to-cash. Replace guesswork with a simple, transparent worksheet:

Core formulas

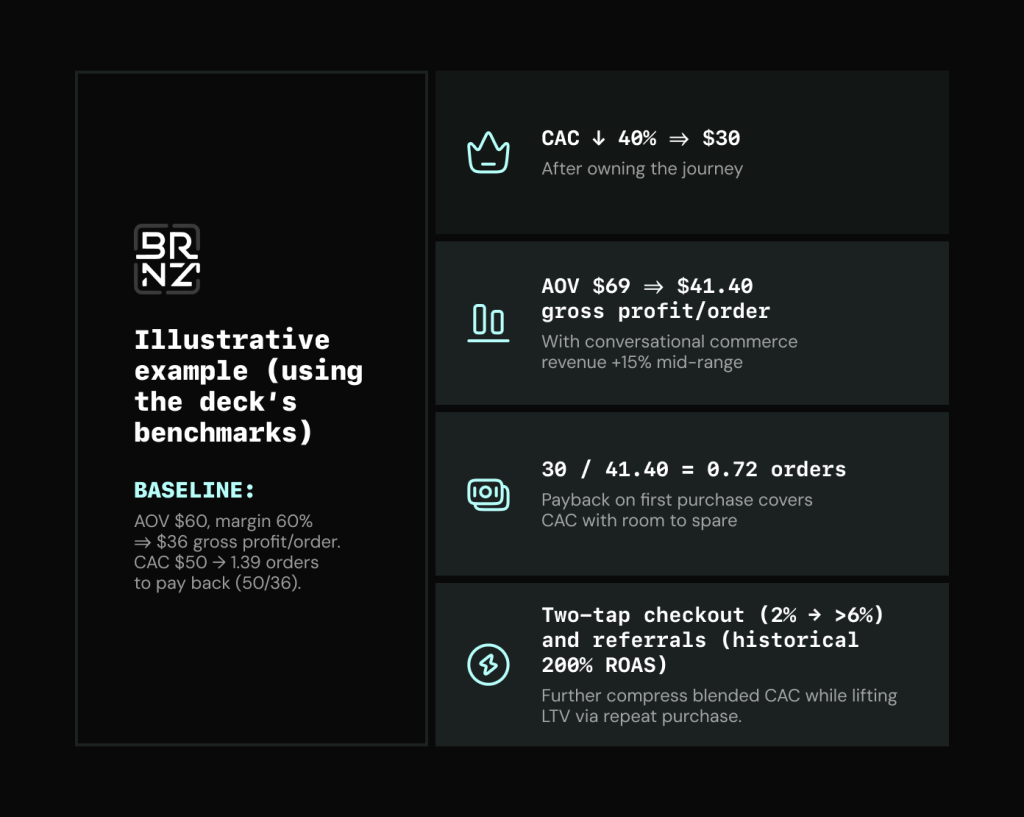

Illustrative example (using the deck’s benchmarks):

What this means to an investor: shorter cash cycles, higher contribution per cohort, and earlier reinvestment of free cash flow. You’re funding compounding instead of patching leaks.

The 30-day path to proof (not promises)

You don’t need a year of replatforming to validate this math:

-

Week 1 – Connect catalogue & channels; pixel every entry point; capture emails + wallets at first touch.

-

Week 2 – Launch conversational flows (cart rescue, product quiz, order status); ship engagement quests.

-

Week 3 – Switch on embedded payments; activate referrals; monitor CAC, AOV, LTV in live dashboards.

-

Week 4 – Layer gamification; route 100% traffic through the owned stack; iterate daily from KPI deltas.

By the end of the first month you should see payback compression in black and white—because every click, conversation, checkout, and share now lands in your ledger.

If you ignore this, here’s the bill

Ad inflation + checkout friction + data leakage = a silent tax on every campaign. You’ll work harder for flat cohorts, finance working capital longer, and pray the board accepts “attribution complexity” as an excuse. They won’t. Own the journey or keep subsidizing someone else’s P&L.

BRNZ (what runs this playbook)

BRNZ is a no-code, investor-grade stack built to own the journey out of the box: Acquisition Engine, Visual Bot Builder, Engagement & Gamification, Referral Engine, embedded PayPal/Stripe/crypto payments, and Intelligence Dashboards—live in <24 hours. The platform’s multi-agent AI and “Cash Bot Machine” automate ops, while a Hero-to-Winner roadmap guides founders from Connect2Hero to ScaleUp2Exit. An ecosystem of 17 partner companies and an investor network accelerates pilots into scale—so the ROI math above isn’t theory; it’s an operating system.

🚀 Turn your expertise into a $20M startup in 24 months with BRNZ.

Let’s see if there’s a fit 👉 https://calendly.com/brnzai