𝘕𝘷𝘪𝘥𝘪𝘢 𝘊𝘰𝘳𝘱.’𝘴 𝘳𝘦𝘭𝘦𝘯𝘵𝘭𝘦𝘴𝘴 𝘳𝘢𝘭𝘭𝘺 𝘩𝘢𝘴 𝘱𝘳𝘰𝘱𝘦𝘭𝘭𝘦𝘥 𝘵𝘩𝘦 𝘴𝘦𝘮𝘪𝘤𝘰𝘯𝘥𝘶𝘤𝘵𝘰𝘳 𝘨𝘪𝘢𝘯𝘵’𝘴 𝘮𝘢𝘳𝘬𝘦𝘵 𝘤𝘢𝘱𝘪𝘵𝘢𝘭𝘪𝘻𝘢𝘵𝘪𝘰𝘯 𝘰𝘷𝘦𝘳 𝘪𝘵𝘴 𝘮𝘦𝘨𝘢-𝘤𝘢𝘱 𝘵𝘦𝘤𝘩 𝘱𝘦𝘦𝘳𝘴, 𝘩𝘦𝘭𝘱𝘪𝘯𝘨 𝘪𝘵 𝘤𝘭𝘪𝘯𝘤𝘩 𝘵𝘩𝘦 𝘵𝘪𝘵𝘭𝘦 𝘰𝘧 𝘵𝘩𝘦 𝘸𝘰𝘳𝘭𝘥’𝘴 𝘮𝘰𝘴𝘵-𝘷𝘢𝘭𝘶𝘢𝘣𝘭𝘦 𝘤𝘰𝘮𝘱𝘢𝘯𝘺 𝘢𝘴 𝘵𝘩𝘦 𝘢𝘳𝘵𝘪𝘧𝘪𝘤𝘪𝘢𝘭 𝘪𝘯𝘵𝘦𝘭𝘭𝘪𝘨𝘦𝘯𝘤𝘦 𝘸𝘢𝘷𝘦 𝘤𝘰𝘯𝘵𝘪𝘯𝘶𝘦𝘴.

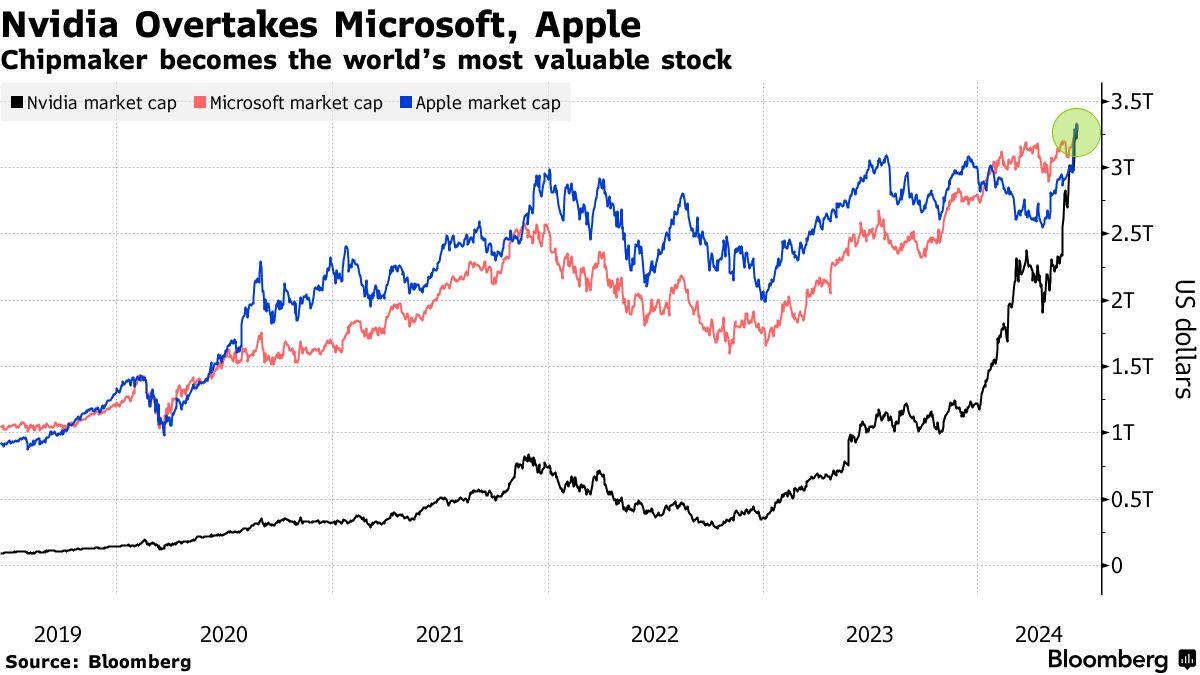

The stock rose 3.5% to close at $135.58 a share Tuesday, putting the company’s market value at about $3.3 trillion and catapulting it over those of Microsoft Corp. and Apple Inc. The top stocks have jockeyed all month for the pole position, with Nvidia finally edging past both of its big-tech peers.

Earlier in the month, Nvidia capped Apple by market value for the first time since 2002, and the two went back and forth in rankings in recent days. Last week, Apple also overtook Microsoft to trade in the top spot briefly.

The ranking is yet another reminder that AI is the top focus of many investors. Nvidia is seen as the biggest and earliest beneficiary of the technology as it dominates the market with its highly sought-after chips that help power data centers running complex computing tasks required by AI applications. Demand for its H100 accelerators are surging and helped drive the chipmaker’s sales up by more than 125% last year.

Microsoft, for its part, is also seen as an early AI winner given its investment and partnership with OpenAI, which created ChatGPT. And, this week, Apple shares rallied after the iPhone maker finally unveiled its plan for using the technology, appeasing investors at long last.

“We believe over the next year the race to $4 Trillion Market Cap in Tech will be front and center between Nvidia, Apple, and Microsoft,” Daniel Ives, analyst at Wedbush Securities, wrote in a note.

Nvidia’s surging stock price has made co-founder and Chief Executive Officer Jensen Huang one of the world’s richest people. His net worth has climbed nearly $75 billion since the beginning of the year to $119 billion, putting him in 12th place on the Bloomberg Billionaires Index. That’s the biggest gain among his billionaire peers.

Investors, alongside Huang, argue that Nvidia is more than a chipmaker.

“They’re not just selling chips, they’re selling systems,” Michael Lippert, vice president and portfolio manager at the Baron Capital Inc., said in an interview, pointing to the company’s proprietary software and development ecosystem.

Nvidia’s swift climb to the top has been record breaking, as the company is one of the few firms to have demonstrated significant revenue growth from AI. Shares have risen more than 170% in 2024 through Tuesday’s close, adding more than $2 trillion to its market capitalization.

“Nvidia’s GPU chips are in essence the new gold or oil in the tech sector as more enterprises and consumers quickly head down this path with the 4th Industrial Revolution well underway,” said Ives.