Powerful New Chips and Investor Skepticism

When Jensen Huang addressed Nvidia’s annual general meeting, he didn’t mention the recent slide in Nvidia’s share price. Despite reaching a peak market value of $3.4 trillion on June 18, Nvidia saw a significant drop, shedding about $550 billion as tech investors combined profit-taking with doubts about sustaining such rapid growth.

Promising New Technologies

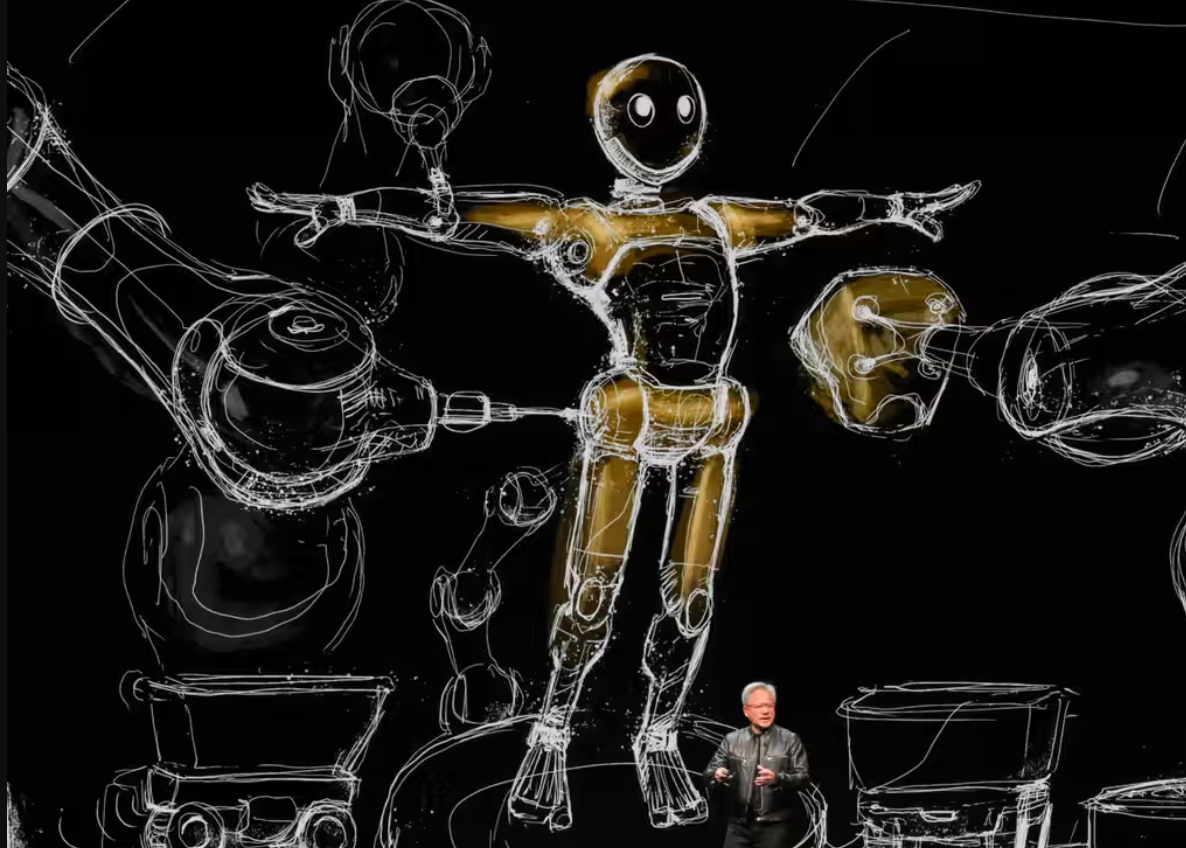

Huang emphasized Nvidia’s new powerful chips, called Blackwell, describing them as potentially the most successful products in the company’s history. He highlighted the transformative potential of AI, predicting it would automate $50 trillion of heavy industry. Huang’s optimistic vision for Nvidia aims at reinventing the company and the broader computer industry.

Investor Outlook and Competitive Landscape

Alvin Nguyen from Forrester believes only a collapse of the generative AI (genAI) market would prevent Nvidia from reaching a $4 trillion valuation. However, the path to $4 trillion is fraught with uncertainties. If upcoming AI models like GPT-5 from OpenAI underperform, it could affect Nvidia’s share price. Moreover, technological advancements could reduce the need for extensive computing power, impacting demand.

Nvidia’s Unique Position

Nvidia remains a pivotal player in the AI boom, thanks to its GPUs, which are essential for AI training and operations. The company’s chips power data centers running complex AI tasks, making Nvidia a top choice for AI investments. While competitors like Google and Amazon are developing their own chips, Nvidia’s GPUs are still in high demand.

Challenges Ahead

Despite Nvidia’s strong position, challenges remain. Smaller companies are offering specialized chips, and big tech rivals continue to develop their own AI technologies. Additionally, Nvidia’s reliance on semiconductor foundries like TSMC could impact its profit margins.

The Bear Case

Neil Wilson from Finalto suggests that Nvidia’s current demand might not be sustainable. Over-ordering by customers could lead to cancellations, slowing growth. Jim Reid from Deutsche Bank highlights Nvidia’s rapid growth but questions whether it can maintain this pace.

Conclusion

Nvidia’s journey to a $4 trillion valuation hinges on continued AI advancements and market demand. While there are challenges, the potential for AI to revolutionize industries keeps Nvidia at the forefront of the tech boom. The race to $4 trillion is more than just a milestone—it’s about leading the next industrial revolution.