Artificial intelligence is shedding new light on the future of cryptocurrencies. Predictions suggest certain digital tokens could see significant growth by 2025. This analysis delves into which assets might experience a surge in value. The insights revealed may catch investors by surprise, highlighting opportunities that are often overlooked.

Artificial Intelligence Predicts 4900% Growth for CYBRO

Cybro is a DeFi platform currently in presale. It has already raised $3.5 million and has over 10,000 holders of its native CYBRO tokens. The initial price of $CYBRO was $0.01, and its listing price is planned to be $0.06.

With this input, artificial intelligence predicts that long-term success of Cybro would hinge on the platform’s ability to differentiate itself, maintain a secure ecosystem, and adapt to market needs.

Given its initial growth—from an entry price of $0.01 to a projected listing price of $0.06—the project has already shown strong early interest and adoption. If CYBRO maintains its development pace, continues to engage its community, and benefits from a favorable crypto market, it could see substantial price growth by 2025.

Artificial intelligence provided a scenario-based outlook:

Conservative Growth: Assuming CYBRO experiences gradual but steady growth post-listing, a target of $0.10 – $0.15 by 2025 could be reasonable, driven by organic adoption and regular feature rollouts.

Moderate Growth: If CYBRO gains wider DeFi adoption and sustains strong community engagement, it might reach between $0.20 – $0.30, especially if it introduces unique features that set it apart in the DeFi space.

High Growth (Bull Scenario): In a thriving crypto market, with high adoption and use-case expansion, CYBRO could potentially reach $0.50 or higher by 2025. This would depend on sustained development, strategic partnerships, and a bullish market environment.

If the best-case scenario unfolds and CYBRO reaches $0.50 from its initial price of $0.01, the percentage increase would be 4,900%.

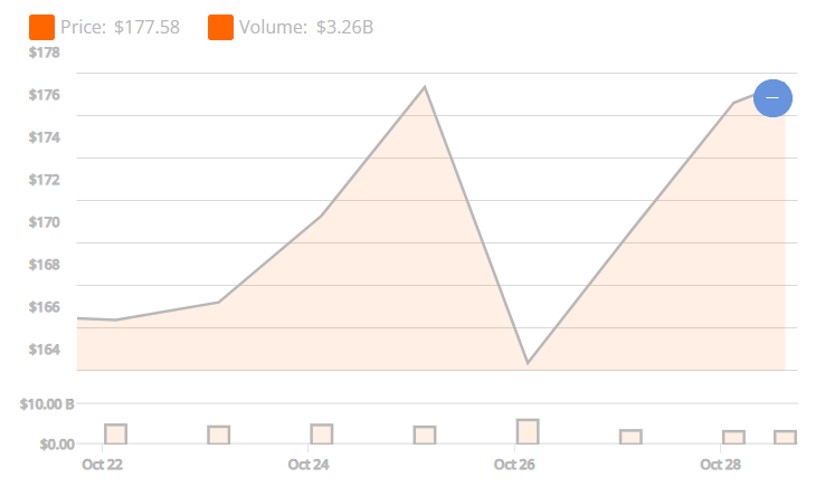

Solana’s Upward Trend Signals Potential for Further Growth

Solana (SOL) is trading between $164 and $184, showing steady growth over the past six months with an increase of nearly 39%. The current price is close to its 10-day simple moving average, slightly above the 100-day average, suggesting a bullish trend. The Relative Strength Index is under 60, indicating room for further growth before reaching overbought conditions. A positive MACD signals upward momentum. If SOL surpasses the nearest resistance level around $191, it could aim for the next resistance near $211, offering potential gains. However, if it falls below the support around $151, it may test the next support level. Overall, the technical indicators suggest Solana has potential for continued growth.

Ethereum Poised for Potential Rebound Amid Bullish Technical Signals

Ethereum (ETH) is currently trading between $2335 and $2722, showing modest declines over the past week and month. Technical indicators like the Relative Strength Index (RSI) nearing 62 and a positive MACD level suggest potential bullish momentum. The price is hovering near its 10-day and 100-day Simple Moving Averages around $2494, indicating consolidation. If upward movement continues, Ethereum could rise to the nearest resistance level at just under $2940, representing an increase of about 20% from current levels. Conversely, if the price dips, it might test the nearest support level around $2165.

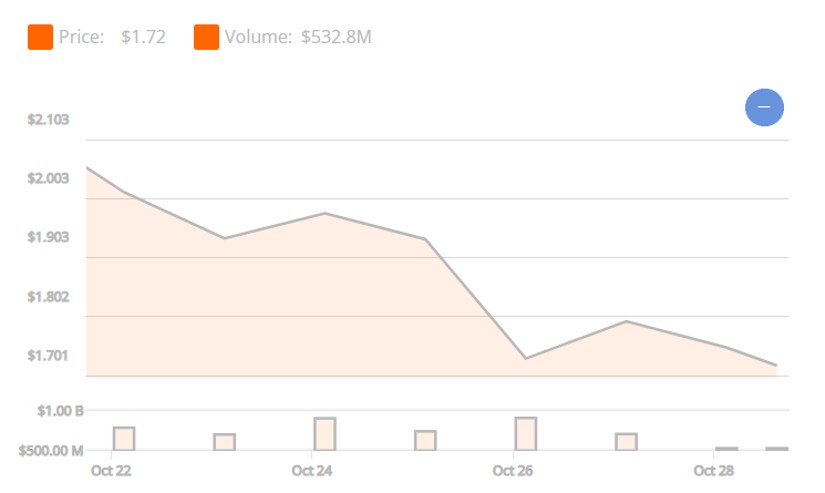

Sui (SUI) Shows Mixed Signals Amid Price Fluctuations

Sui (SUI) is experiencing market volatility, with its current price fluctuating between $1.54 and $2.07. Over the past week, the price has decreased by 18.43%, but it has gained 4.66% in the last month and surged 51.87% over six months. The Relative Strength Index (RSI) at 47.73 suggests a neutral trend. The coin is approaching its nearest resistance level at $2.39; surpassing this could lead to the next resistance at $2.93, representing a potential increase of about 42%. On the downside, the nearest support is at $1.32, and falling below this might see the price testing the second support at $0.79. Traders are watching these levels closely for potential movements.

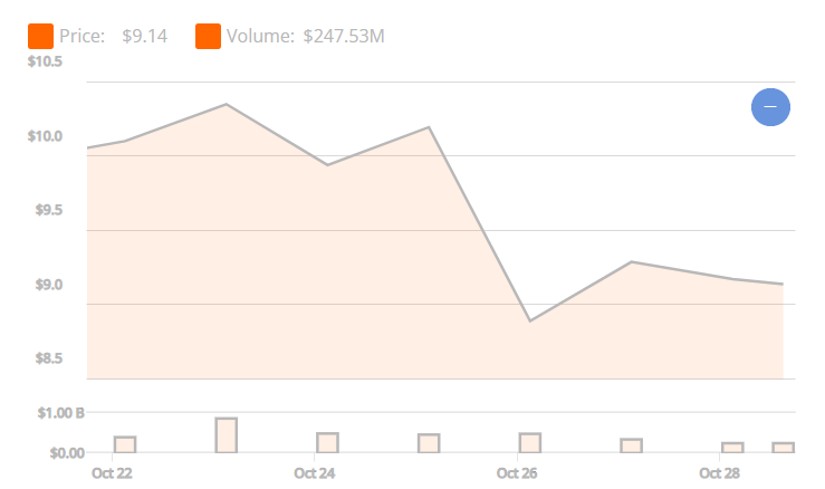

Aptos (APT) Faces Mixed Signals Amid Price Fluctuations and Key Levels

Aptos (APT) is currently trading between $8.03 and $10.79, showing mixed signals in its price movement. Over the past week, the price decreased by 7.45%, but it increased by 8.53% over the past month. The Relative Strength Index (RSI) stands at 57.07, indicating neutral momentum. The nearest resistance level is at $12.39, and breaking this could see the price rise toward $15.14. The nearest support level is at $6.87, and falling below it could lead to a drop to $4.11. The Simple Moving Average over 10 days is $8.99, below the 100-day average of $9.47, suggesting bearish tendencies. Traders should watch for moves above resistance or below support levels.

Conclusion

An analysis of various tokens suggests that SOL, ETH, SUI, and APT may have less potential in the short term. In contrast, CYBRO emerges as a standout opportunity. As a technologically advanced DeFi platform, CYBRO offers investors unmatched avenues to maximize earnings through AI-powered yield aggregation on the Blast blockchain. With features like generous staking rewards, exclusive airdrops, and cashback on purchases, it ensures a superior user experience with seamless deposits and withdrawals. By emphasizing transparency, compliance, and quality, CYBRO distinguishes itself as a promising project attracting significant interest from crypto whales and influencers.

Disclaimer: Always conduct thorough research, and seek advice from financial experts before making investment decisions. Cryptocurrencies are inherently volatile and carry significant risks.