The newest “invention” that will crash the crypto markets is synthetic stablecoins.

Synthetic stablecoins are tokens that pretend to have stable 1:1 value to the US dollar but in reality, do highly risky trading to generate yield, for the fools who decide to hold those garbage coins.

𝘛𝘩𝘦 𝘮𝘰𝘴𝘵 𝘱𝘰𝘱𝘶𝘭𝘢𝘳 𝘴𝘺𝘯𝘵𝘩𝘦𝘵𝘪𝘤 𝘴𝘵𝘢𝘣𝘭𝘦𝘤𝘰𝘪𝘯 𝘪𝘴 𝘌𝘵𝘩𝘦𝘯𝘢 𝘜𝘚𝘋 𝘸𝘩𝘪𝘤𝘩 𝘫𝘶𝘴𝘵 𝘳𝘦𝘤𝘦𝘯𝘵𝘭𝘺 𝘤𝘳𝘰𝘴𝘴𝘦𝘥 $2 𝘣𝘪𝘭𝘭𝘪𝘰𝘯 𝘪𝘯 𝘭𝘪𝘲𝘶𝘪𝘥𝘪𝘵𝘺.

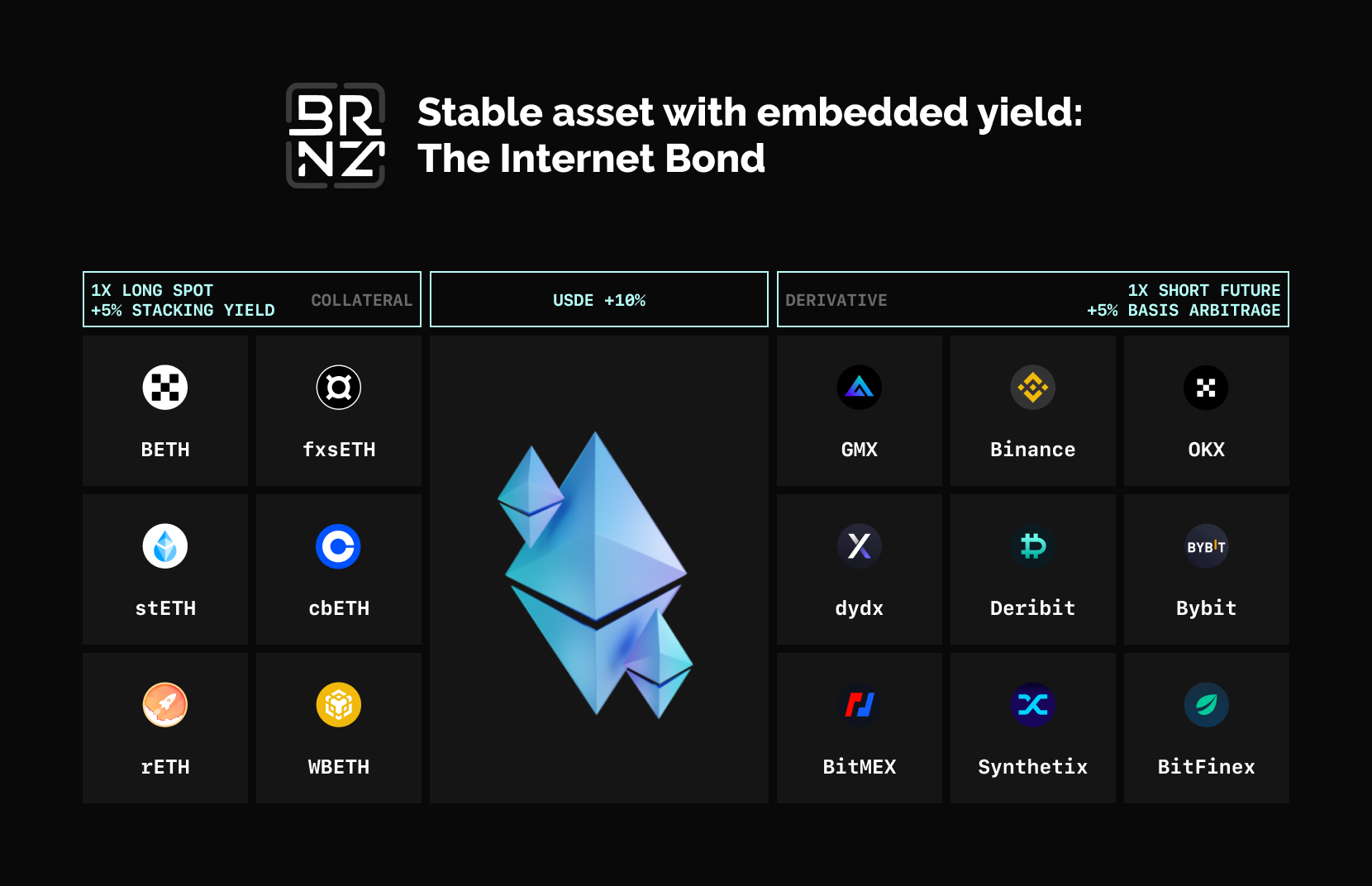

Ethena takes enormous risks for the holders by doing a basis trade, a well-known hedge fund trading strategy.

Ethena makes bets in the derivatives markets by shorting the futures/perps and going long spot.

Ethena takes enormous risks for the holders by doing a basis trade, a well-known hedge fund trading strategy.

Ethena makes bets in the derivatives markets by shorting the futures/perps and going long spot.

Ethena pretends to be a stablecoin but it is actually an unregulated crypto hedge fund.

Ethena pretends to be a DeFi protocol when it’s actually custodizing clients’ assets on their balance-sheet.

Ethena pretends there are no risks in their stablecoins when it’s actually speculating in the derivatives markets.

Ethena pretends to be an alternative to Tether when its hedging strategy depends on USDT given that only linear perpetual contracts have enough liquidity to support their basis trade.

Ethena tricks USDe holders by giving them a false impression of safety & security by claiming USDe is a “stablecoin” but is actually taking huge risks by doing a basis trade.

You really can’t this stuff up – crypto degenerates are so thirsty for high yield that they will put liquidity in garbage such as synthetic stablecoin.

To make it clear: synthetic stablecoins are highly risky and will blow up the crypto markets.

When the crash happens there’s not going to be a bailout because crypto cannot be bailed out.